Income Tax Rates 2024/24 Uk. 2023/2024 tax rates and allowances. Dividend income is taxed at 8.75% (income up to the basic rate), 33.75% (higher rate) and 39.35% (additional rate).

2024 Tax Rates And Standard Deductions Gabbi Joannes, Scottish top income tax rate rise. From 6 april, the top.

Gift Tax Rates 2024 Uk Karin Marlene, For the tax year 2023/202 4, the uk basic income tax rate was 20%. After that, a 2pc rate applies.

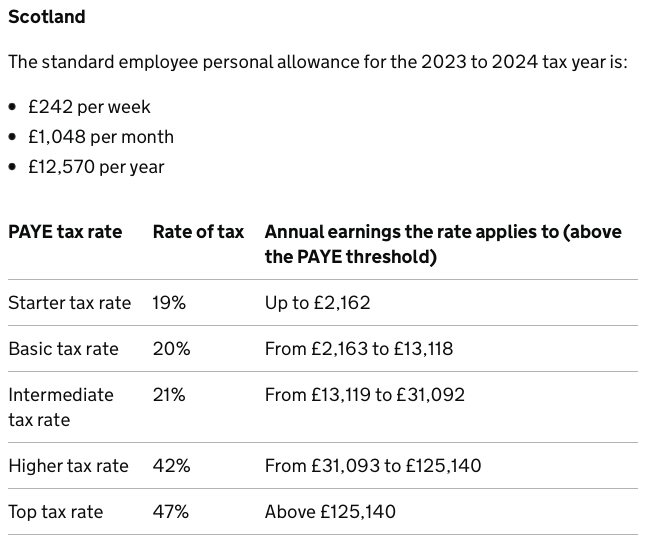

What Are The Tax Brackets For 2024 Uk Dollie Leland, Income tax rates vary for people living in scotland and are as follows: Income tax and dividend tax rates for england, wales & northern ireland in.

Tax rates for the 2024 year of assessment Just One Lap, This is a 8.5% increase from last year, in line with september’s. Up to 20%, depends on the type of income.

2024 Corporate Tax Rates in Europe Tax Foundation, Dividend income is taxed at 8.75% (income up to the basic rate), 33.75% (higher rate) and 39.35% (additional rate). Personal allowanceno longer seperate age.

2024 Tax Code Changes Everything You Need To Know, Income tax rates vary for people living in scotland and are as follows: The pt for class 1 nics, lpt for class 2 nics and lpl for class 4 nics will remain aligned with the personal allowance for income tax until the 2027 to 2028.

Scottish Rate of Tax (SRIT) BrightPay Documentation, After that, a 2pc rate applies. The following table shows the updated dividend tax rates for the 2024/25 tax year:

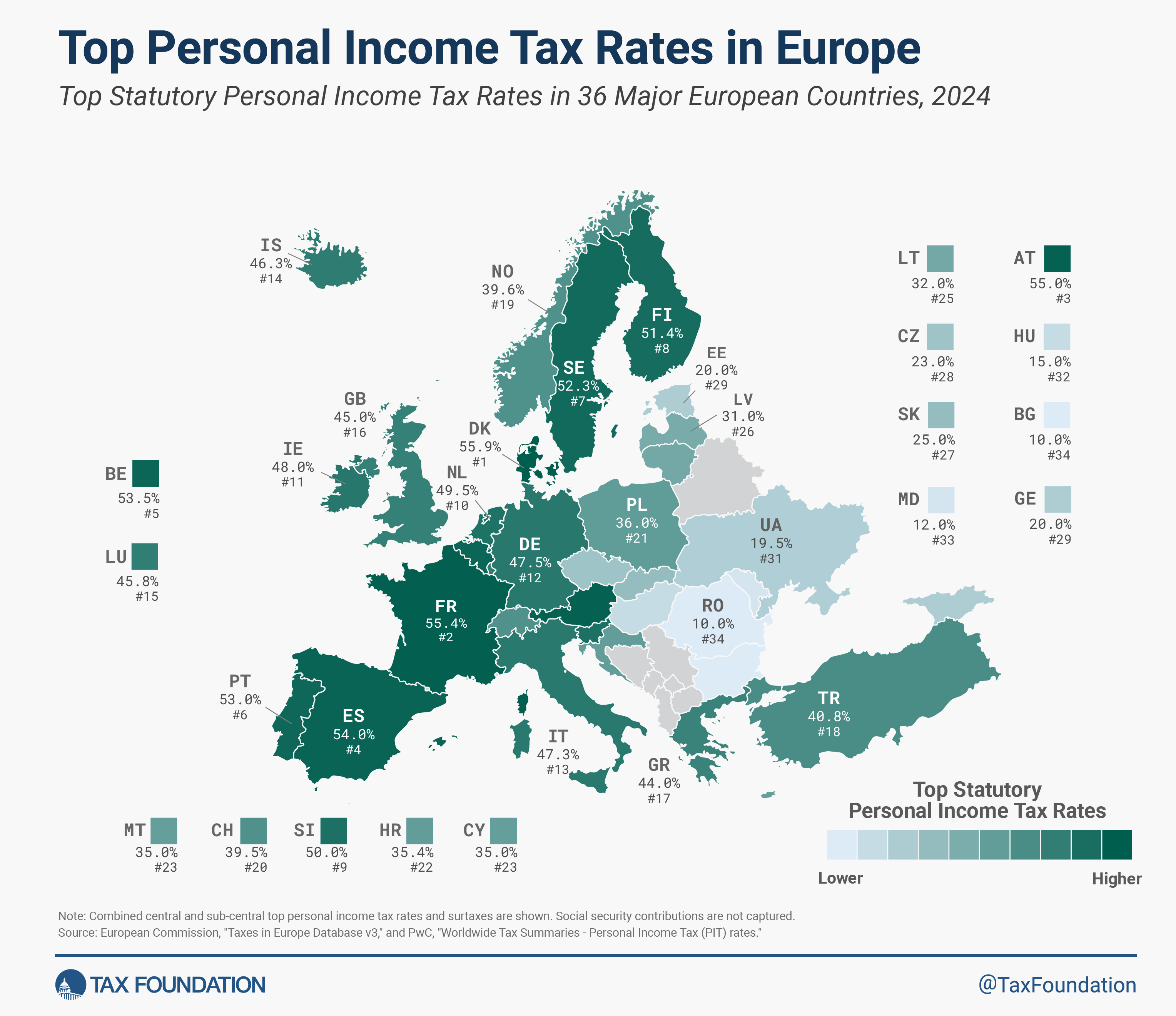

2024 Personal Tax Rates in Europe Tax Foundation, Class one nics of 8pc apply to employees who earn between £242 a week and £967 a week (£12,570 to £50,270 a year). The following table shows the updated dividend tax rates for the 2024/25 tax year:

Tax Slab Rates FY 202324 & AY 202425 (New & Old Regime Tax, For 2023 to 2024 and 2022 to 2023, the national insurance contributions rates for directors are different. 2023/2024 tax rates and allowances.

Taxable Chart 2024 Dion Myrtie, This will apply to workers aged 21 or over. From 1 april, the national living wage will be rising to £11.44.